The complexities of VAT (Value Added Tax) in the European Union can be a daunting challenge for online businesses. The WooCommerce EU VAT Number Nulled plugin emerges as a beacon of clarity, simplifying the intricate maze of EU VAT regulations for e-commerce store owners using WooCommerce. This plugin is essential for ensuring compliance and streamlining tax handling across the European market.

Overview:

WooCommerce EU VAT Number plugin is tailored for businesses selling goods and services to customers within the European Union. It provides a robust solution for managing and automating VAT calculations, enabling businesses to handle cross-border transactions with ease and accuracy. With the EU VAT Number plugin, businesses can effortlessly navigate the VAT rules, ensuring compliance and avoiding potential penalties.

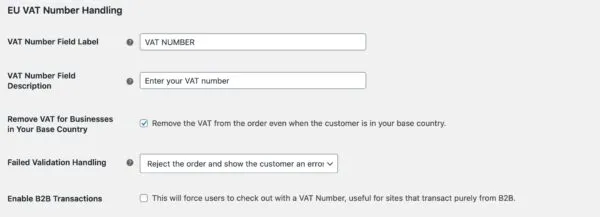

Features:

- Automatic VAT Calculation: The plugin automates the VAT calculation process based on the customer’s location, removing the need for manual calculations and reducing the risk of errors.

- VAT Number Validation: Businesses can collect and validate customer VAT numbers at checkout, ensuring that all transactions are compliant with EU regulations. The plugin integrates with the VIES (VAT Information Exchange System) for real-time validation.

- Reverse Charge Mechanism: For B2B transactions within the EU, the plugin supports the reverse charge mechanism, allowing businesses to shift VAT liability to the customer, as per EU guidelines.

- Geo-Location Features: By utilizing geo-location, the plugin determines the customer’s location and applies the appropriate VAT rate, ensuring compliance with the varying VAT rates across EU member states.

- Customizable VAT Exemption: Businesses can configure VAT exemption rules for certain products, services, or customer groups, offering flexibility in how VAT is applied.

- Digital Goods Compliance: For digital goods, the plugin adheres to the EU’s MOSS (Mini One-Stop-Shop) scheme, simplifying VAT collection and submission for cross-border digital sales.

- Detailed Reporting: WooCommerce EU VAT Number Nulled provides detailed VAT reports, facilitating accurate VAT return filings and record-keeping.

- Multiple Currencies Support: The plugin seamlessly handles transactions in various currencies, converting VAT amounts based on current exchange rates.

- Customer-Friendly Checkout: It streamlines the checkout process by allowing customers to enter their VAT number for validation, leading to a smoother and more professional checkout experience.

- Integration with Accounting Software: The plugin can integrate with popular accounting software, making it easier to manage VAT records and prepare for tax submissions.

The WooCommerce EU VAT Number plugin stands as a vital tool for e-commerce businesses operating within the European Union. By automating VAT calculations, ensuring compliance, and streamlining tax handling, the plugin allows business owners to focus on what they do best – growing their business.

Its robust feature set not only caters to the complexities of EU VAT regulations but also enhances the customer experience by simplifying the checkout process. With this plugin, businesses can confidently navigate the EU’s VAT landscape, secure in the knowledge that they are fully compliant and their VAT handling is precise and efficient.

Adopting the WooCommerce EU VAT Number plugin is not just about compliance; it’s about peace of mind. It’s about knowing that as you expand your reach across the European market, the intricacies of VAT will not hinder your growth. This plugin empowers businesses to transcend borders, embrace the European market, and thrive in a unified economic space with diverse VAT regulations.

In essence, the WooCommerce EU VAT Number Free Downloadplugin is more than a compliance solution; it’s a strategic asset for any business aiming to make a mark in the European e-commerce landscape. It’s the silent sentinel of VAT compliance, working tirelessly behind the scenes to ensure that every transaction is compliant, every VAT calculation is accurate, and every customer experience is seamless. It’s an investment in the financial integrity and international ambitions of your e-commerce venture.

Changelog

Version 2.9.5

RELEASED ON 2024-07-15

Bump WooCommerce "tested up to" version 9.0.Bump WooCommerce minimum supported version to 8.8.Bump WordPress "tested up to" version 6.6.Bump WordPress minimum supported version to 6.4.Update NPM packages and node version to v20 to modernize developer experience.Issue with cart being emptied when invalid VAT is removed.Issue with empty VAT field when the VAT number is stored under My Account > VAT Number.Undefined javascript variable error.

Version 2.9.4

RELEASED ON 2024-05-20

"Use shipping address for validation" setting to choose the address for VAT number validation.

Bump WooCommerce "tested up to" version 8.9.

Bump WooCommerce minimum supported version to 8.7.

Change the messaging around EU VAT laws.